Elfriede Sixt

Comme vous le savez, nos collègues germanophones avaient déjà des inquiétudes quant à la situation de Wirecard en Allemagne en 2016. ING a acheté une partie importante des actions de Payvision au printemps 2018. Au courant du même printemps 2018, il y a apparemment eu une divergence d’opinion au sein du ministère public à propos de l’affaire concernant le règlement où ING a du leur payer €775 millions d’euros. Entre-temps, la Cour d’appel de La Haye n’a pas encore pris de décision dans l’affaire demandant l’ouverture d’une procédure pénale contre l’ancien PDG d’ING, M. Ralph Hamers. En février 2020, il a été annoncé que Hamers pourrait rejoindre UBS. Nous publions ici mon article en anglais. Il était clair que ce type de fraude à grande échelle rendait le rôle des régulateurs encore plus important.

The operating companies (merchants) of the fraud online trading scams have been shell companies, mostly British, with nominee directors and nominee shareholders. Although the majority of contracts between Payvision and the companies operating the scams were signed by these straw men, according to the statements made in interrogations of these straw men, there were neither any communication or meetings at all between them and Payvision. The communication as well as the agreements were made directly with the Ultimate Beneficial Owners (UBO) behind the scams. Uwe Lenhoff and the Israeli Gal Barak discussed all the scam details themselves whereas on the Payvision side, communication at the board level was either done by Rudolf Booker himself or by Gijs op de Weegh.

Personal relationships

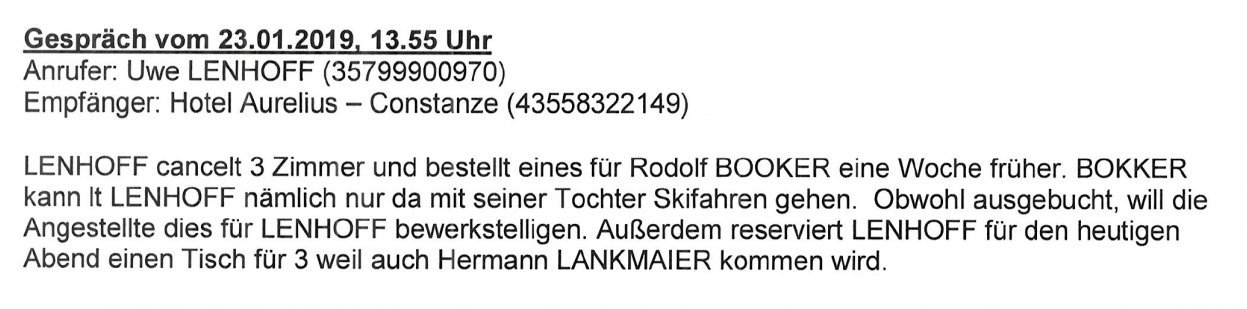

Booker and Lenhoff had a close private relationship (joint skiing holiday) according to the tapped telephone logs between Booker and Lenhoff. Although the acquiring contracts between Payvision and the fraudulent brands were terminated in December 2018, phone calls between Booker and Lenhoff about the business took place until the end of January 2019 – the latest one two days before Lenghoff was arrested.

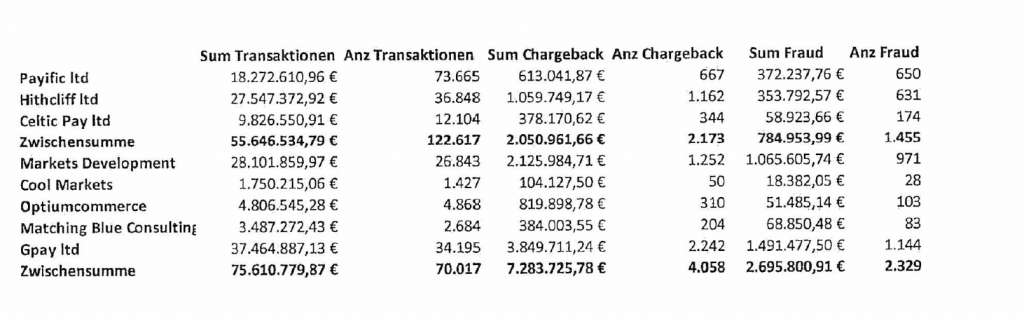

Total stolen money processed by Payvision

Accordingly, the companies attributed to Uwe Lenhoff and platforms generated a total turnover (stolen money) of EUR 55,646,534.79 with Payvision. The companies and platforms attributed to Gal Barak show a total turnover of EUR 75,610,779.87 with Payvison. Chargebacks are a repayment process which is initiated by the credit card holder. Booker stated that although the chargeback rate was high, Gal Barak achieved around 65% and Uwe Lenhoff around 40% of repayments successfully combated. Payvision’s own fees were charged for these chargebacks. Later a “single rate” was introduced, which included the commission and chargeback fees. So Booker was aware of all the chargebacks by the distressed victims – he just did not care.

The amounts stated only cover the schemes from Uwe Lenhoff and Gal Barak, not all the other scams which have been and probably are still processed by Payvision – a subsidiary of ING.

Warnings from European Supervisory Authorities

There had already been warnings published by various financial market supervisory authorities against the fraud schemes from Uwe Lenhoff and Gal Barak from 2016 onwards (see below), but Payvision ignored all of them. On the contrary, Booker urged Uwe Lenhoff to sign a referral agreement with Uwe Lenhoff providing him a fee for other scam referrals – however, Lenhoff was arrested before that happened.

Reward for the founders and board of Payvision

In September 2019, ING bought the remaining 25% share in Payvision, although ING must have already known about the kind of business Payvision was involved in, so they “rewarded” Booker and his partners with even more money. At the same time, hundreds and thousands of unsuspecting European consumers have suffered from having been ripped off and having lost their life-time savings to scammers with the support of Payvision.

Actions of EFRI

The EFRI (European Funds Recovery Initiative) is based in Vienna. EFRI is an investors protection initiative to fight for the right of victims of investments scams. In our opinion, Payvision is Netherland´s WIRECARD – a company helping scammers in big style fraud. We filed a money laundering complaint against Payvision already in summer 2019 (except for a receipt confirmation, no response has been received from the relevant authorities). After having much more information now found in the criminal file as well as detailed information on the total volume, we are about to send an updated version to the Dutch Central Bank – in charge for Payvision.

We requested the restitution of the payments to the victims from Gal Barak (claim letter here) and Uwe Lenhoff as enclosed from Payvision. No response received from them up until now.

We are preparing legal steps against Payvision

Please get in touch: For any lawyers and for press people interested in seeing the material in the criminal files of Gal Barak and Uwe Lenhoff, please contact us.

1) Despite the fact that Stichting Trusted Third Party Payvision and Stichting Trusted Third Party Acapture are not a subsidiary of Payvision Holding, they are consolidated. A special framework is formulated in an agreement between Stichting Third Party Payvision and Payvision B.V., whereby Stichting Third Party Payvision provides execution of payment services exclusively to Payvision B.V. and/or its merchants. The agreement stipulates that operational deposits are to be held and used to cover the operational financial exposure, which may arise if and when negative collections are imposed upon merchant accounts. The agreement also states that Payvision B.V. bears all costs in relation to the execution of services, profit and losses of Stichting Third Party Payvision such as all taxes, bank charges and also those financial and economic risks in relation to the accounts operated by Stichting Third Party Payvision. A similar agreement is in place between Stichting Trusted Third Party Acapture and Acapture B.V.